In August 2022, President Joe Biden signed the Inflation Reduction Act into law and repealed the previous electric vehicle tax credit that had been in effect since 2010. Unlike the previous guidelines, in which any EV could qualify for a tax credit of up to $7,500 as long as the manufacturer hadn’t sold over 200k EVs, the Inflation Reduction Act only favored electric vehicles made in America with no limit on the manufacturer sales. As a result, major automakers such as Tesla and GM made it back on the list after they were locked out in the old rules for surpassing the 200k sales.

However, electric vehicles that are made in North America are required to meet specific requirements to qualify for the federal EV tax credit. More succinctly, the federal government imposed a price cap limit and a certain percentage on the battery components and critical minerals that are used to manufacture electric vehicles. But that’s not all; the requirements get higher every year, which means fewer EVs will qualify for the $7,500 federal tax credit in 2024 than in 2023. Why is it so?

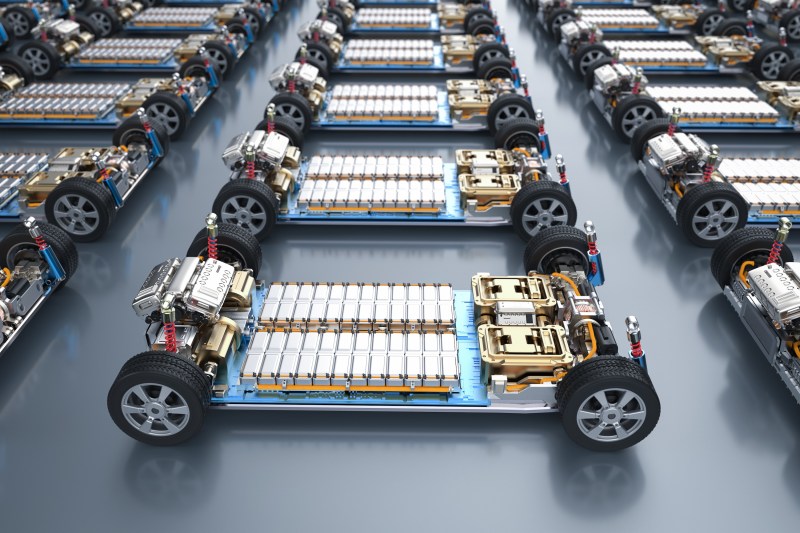

A higher percentage of materials must be produced in North America for EVs to qualify

In 2022 and 2023, the EVs that qualified for the $7,500 federal tax credit were required to have 40 percent of the “critical minerals” and 50 percent of the battery components manufactured in North America — according to the U.S. Department of Treasury. But as soon as the clock hit 1st January 2024, the criteria to qualify for the $7,500 federal tax credit changed to 50 percent of critical minerals and 60 percent of battery components. Because of that, fewer EVs qualify for the $7,500 federal tax credit in 2024 than last year.

However, the new rules are only applicable to electric vehicles coming out of the production plant in 2024. This means that you could still claim the EV federal tax credit under the previous criteria if you registered your new electric vehicle before 1st January 2024. At the moment, only four 2024 EV models, which include the Tesla Model Y, Model 3, Model X, and F-150 Lightning, qualify for the full $7,500 federal tax credit. But if you were buying a new electric vehicle last year, you had an option of 14 electric cars that qualified for the full federal tax credit.

Of course, we expect more electric cars to be eligible for the $7,500 tax credit over the next few months as more automakers adjust to the new rules. But if you want an EV that is yet to qualify and you want to save money, you should consider leasing an electric car instead. In fact, if you’re leasing an EV, it could be eligible for the full tax credit without a price limit. The government is also providing subsidies to support the charging infrastructure and encourage more people to buy EVs.

Editors' Recommendations

- 2024 Toyota Land Cruiser: Tech, off-road chops, pricing, and more

- Aston Martin delays launch of its first EV, says drivers don’t want electric cars

- Ford plays it all ways, focusing on EVs, hybrids, and gas engines

- VW ID.7 Tourer flagship EV will have up to 426 mile range

- Indian Motorcycle, Roland Sands Design collaborate on special edition 2024 FTR x RSD Super Hooligan